Who is BankOpen?

Earlier this week, Asia’s first Neo-bank “BankOpen” raised $30 million in a new funding round as investors found an opportunity to replicate a globally tried and tested business idea in the emerging market- Fintech Mobile App Startups. The Series B financing round for the start-up was led by Tiger Global with Tanglin Venture Partners Advisors. The pre-existing investors that also participated in the funding round include 3one4 Capital, Speedinvest, BetterCapital AngelList Syndicate. This round valued BankOpen at $150 million, and has raised about $37 million till now.

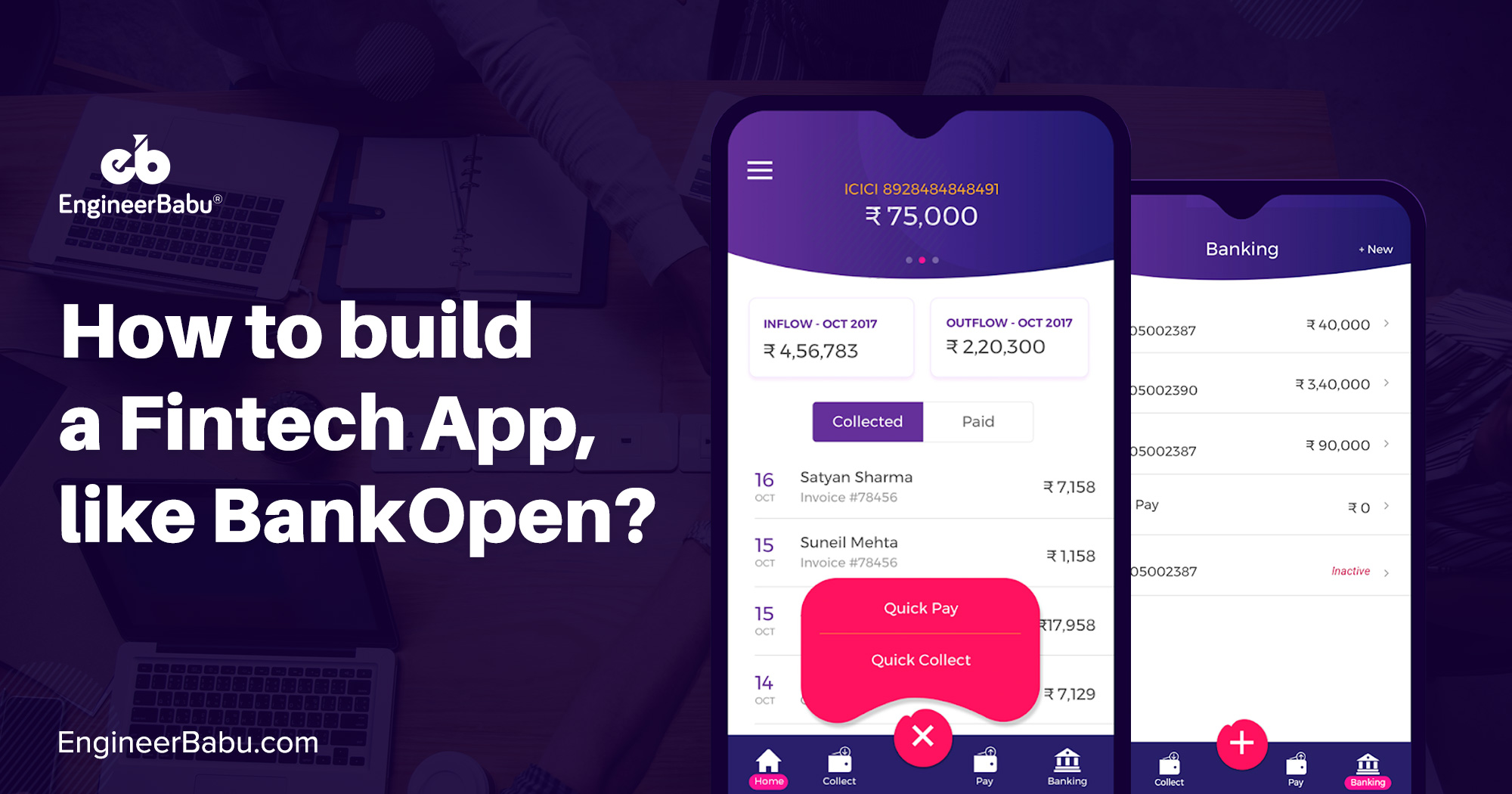

BankOpen has partnered with ICICI Bank for creation of accounts. On ICICI Bank’s internet banking website, BankOpen has integrated its tools including a payment gateway powered by Stripe. It gives back-end support to YES Bank and ICICI Bank. This one of a kind FinTech project was undertaken by EngineerBabu, an award winning IT company for web and mobile development services for StartUps, SMEs, as well as Enterprises.

What Is FinTech and Why it matters?

Neo-banks are conventional banks that do not have any physical branches but only use FinTech Mobile Apps and websites to provide their services. It is basically an institution that provides checking, a prepaid debit card and some form of savings account minus the traditional brick-and-mortar building. It includes P2P payments, mobile deposits, real-time digital receipts and mobile budgeting tools.

For Asia, neo-banking might be a comparatively newer concept, but globally, the experiments with neo-banking have been done by major global banks for close to a decade now and the trend has since then, caught up the entire world. Very recently, banks and FinTech Mobile App companies have started to support each other in this venture to promote digitization, hence easing the banking experience for millions of micro-entrepreneurs and homepreneurs.

Some other Indian neo-banks like BankOpen include- NiYO, 811 by Kotak, Yono by SBI and InstantPay. Monzo, a neobank from the UK, after garnering more than a million customers, is now reportedly going to enter the US market. Some other notable fintech mobile apps across the globe are- Tyro Payments, Volt Bank and Xinja (Australia), bunq and N26 (Europe), Atom Bank, Revolut and Starling Bank (UK), Simple (USA) and WeBank (China).

How BankOpen started?

The vision –

The startup was founded by serial entrepreneurs Anish Achuthan and his wife Mabel Chacko in 2016. They found the inspiration for BankOpen after having come across the financial issues faced by small businessmen across the country. In Ahmedabad, one of their clients, a small businessman has an average of 59 transactions from his customers in the firm’s bank account every few hours. Prior to using BankOpen, the firm had to juggle all day to figure out where these transactions originated from or went to. It was because, on their bank statement, they only see one-line description of a transaction’s detail.

The pain points –

CEO Anish Achuthan in an interview told that, “Traditional banks have either not addressed these small needs, or charge huge amount for their own solutions that is not feasible for a small business.” With over 100,000 customers (around 20,000 coming onboard every month) BankOpen processes about $5 billion in transactions each year. Within the next one year, BankOpen aims to grow its customer base to 1 million. Today it is competing with a handful of startups including InstantPay, but the CEO is of the view that much of the market remains untapped.

The solutions –

The two-year-old Bangalore-based start-up automates accounting and GST, tax filing, bookkeeping, and reconciles bank transfers, cash and cheque payments. In addition to this, it also manages invoicing, payouts, payroll & accounting in one place. It uses a payment gateway powered by Stripe, whose other clients include Google, Microsoft, Amazon, Spotify and Uber.

Team building –

- Zwitch, the previous digital payments venture by Anish Achuthan and Mabel Chacko, was acquired by digital payments firm CitrusPay in September 2015.

- Following the acquisition, Ansih Achuthan joined CitrusPay as vice-president of new initiatives and business head, whereas Mabel Chacko headed the firm’s digital marketing.

- In 2016, the duo quit CitrusPay and founded BankOpen.

- In July 2017, BankOpen raised $250,000 from Amrish Rau, CEO of PayU India and Jitendra Gupta, managing director.

- In November 2017, BankOpen appointed former TaxiForSure chief financial officer Deena Jacob as head of revenue and growth and CFO.

Why is India a Billion dollar market for Fintech/Neo Banking?

In the past 5 years, the SME sector in India has grown as a lively and dynamic sector in the Indian Economy. They play a significant role in Nation’s cross-platform development, but the one aspect that plays a major role in their success is- efficient banking and financial management. Till recently, SMEs faced issues like difficulty in managing multiple bank accounts, bandying out payments to employees, bookkeeping of daily spending. Neo-banking is one good way to drive digital innovation in this sector by providing its clientele with personalised products that not only add value, but also ease their burden effectively.

At the Singapore FinTech Festival in November last year, Indian Prime Minister Narendra Modi introduced attractive policies and plans to invite investors to the Indian landscape amidst the largest ever gathering of FinTech firms. “I say this to all the FinTech companies and startups: India is your best destination,” he said, as the keynote speaker. “Less than 50 per cent of Indians had bank accounts in 2014. Now, it is nearly universal. So today, more than a billion biometric identities, more than a billion bank accounts and more than a billion cell phones give India by far the biggest public infrastructure in the world,” Modi had said. He became the first world leader to address the festival that was launched in 2016 and was in its third edition last year.

Financial Technology and Its Scope In The Developing World:

A Nigerian FinTech startup NetPlus provides simple and reliant digital payment system to the consumers of the nation who initially used to be cynical when it came to using e-commerce. Nigeria has now embraced the platform. Several developments like these have given a boost to evolving markets such as Indonesia, Brazil, India, Nigeria, etc.

London, San Francisco and Singapore, were earlier reserved as the FinTech hubs but the scenario has been changing rapidly. Now these developments are driving investors to huge rewarding markets in developing countries as well, since the growth opportunities here are massive. This shift in the market has now gained a significant attraction and developing nations are experiencing tremendous growth in investments across FinTech and RegTech.

Also, several financial establishments have planned to open up new premises in these countries that is a clear indicator of what is expected to come our way in 2019.

BankOpen and EngineerBabu:

The two companies collaborated in order to build something unique. With EngineerBabu’s expertise in Fintech and BankOpen’s idea they took the first step i.e. MVP. The goal was to a unique integrated payment gateway for customers, so they can accept bank transfers via virtual accounts that auto-categorises their income and expenses. It supports multi-bank connect from 60+ Indian banks to BankOpen.In addition to this, BankOpen is the first API banking platform in the entire region of Asia. The developer friendly banking APIs lets developers easily integrate banking & payments into their applications or accounting systems. From instant account creation to mass payouts, the APIs help the users create a tailored solution which meets their unique payment needs. The simple and easy to integrate REST APIs are built with seamless security in mind that support mass processing. There are no loops, be it a mass payout or mass account creation, all the heavy lifting is taken care of for the customers.

How To Start A FinTech Mobile App Company?

If you have never traded Bitcoins and aren’t sure how stocks work, there’s still a solid chance that you might have used some sort of FinTech services— online banking solutions or mobile payments. In fact, the adoption of fintech globally reached 33% in 2017, as compared to nearly half, 16% in 2015.

The top 3 FinTech Companies and their funding, niche and current values are as understated-

- Stripe– Got a funding of $685 millions in a total of 9 rounds. It is now valued at $20 billions. It’s niche is- Online Payment Service.

- RobinHood– Got a funding of $539 millions in a total of 5 rounds. It is now valued at $ 5.6 billions. It’s niche is- Trading and Investment.

- Lu.com/Lufax– Got a funding of $1.7 billions in 2 rounds of funding and is now valued at approx. $10 billions. It’s niche is- Peer-to-Peer Lending and Financing platform.

Fintech definitely isn’t the easiest industry to target and when all the pitfalls are taken into consideration – It takes time, effort and sweat to create a successful FinTech company. To launch a startup in such a frivolous and competitive domain, it takes a lot of expertise and creativity. The immense and rapid pressure is on the tech companies to deliver huge results. Still, if you believe that you have what it takes to solve the financial issues for your users through innovative means, go ahead. You will be needing the right people by your side.

At EngineerBabu, we have experts when it comes to crafting products that engage your audience, sets your brand apart while helping you achieve your goals. We focus on making sure that the mobile apps and websites we develop for you are both useful and easy to use. Feel free to reach out to us for any consultations.

How Much Does a FinTech Mobile App Cost?

To estimate the cost of any new business venture, the resources including manpower, and the time taken by them to finish the task is what will help you to reach to an estimated figure. When it comes to app development, several factors will decide the costing. It might vary depending on the niche of your app, the target-audience and their population size, the scope of the application you’re going to build, the platform it would be launched on (iOS or Android), etc.

But generally speaking, a Business Analyst takes around 10-15 days. A UI developer would take 15 days to finish his design. Then there are front-end, back-end (for iOS and Android platforms) and testing developers that usually take 70 days, 60 days and 15 days respectively. When all of this is done, the final cost would be around 20,000-30,000 USD for one app.

A lot of other steps are involved in developing a mobile app and you can manage your finances wisely if you know how to balance them by— knowing the regulations, discovering your edge, hiring the right talent along with the right tech stack, creating an MVP (Minimum Viable Product), getting funded and building resourceful partnerships.

EngineerBabu’s Concept in FinTech Mobile App?

Fintech mobile app start-ups are bound to focus more on the customer experience and services in the digital era and engage with the established industry contenders. In the long run, Fintech will be investing more in risk management, innovation techniques and partnerships through collaboration which will be of great aid to both the banking sector and Fintech mobile app companies. The sector also has to innovate the business models and find their place in the B2B sector.

Furthermore, traditional financial contenders will be exploring growth opportunities through new monetization models. As a result, banks will have the benefits from the financial technology company’s knowledge about developing the insights for needs of their customers. New age customers are looking for smooth on-demand transactions and good interpersonal relationships. Hence, what we will be witnessing 2019 onwards is, massive opportunities for Fintechs to add value by artificial intelligence, employing big data, machine learning in the financial services. FinTech is going to be the second-most significant transformation in Finance, since the first permanent banknotes. Fintech is constantly maturing and developing, and many fundamental tasks still need to be explored.

Our team at EngineerBabu makes sure to incorporate our knowledge about this dynamic sector while we create the best website and application platforms for you. With more and more FinTech firms, central banking will surely take a backseat as lenders and borrowers are matched with each other to make a more stable credit exchange. This significantly newer concept has the potential to completely change the way banking functions. FinTech is taking the age-old method of lending and borrowing without the existence of separate institutions while challenging the territorial habits of banking services and traditional insurance.

We at EngineerBabu excel in creating fintech products utilizing the latest tech stacks and we possess immeasurable domain expertise in developing these products. This is why so many of our clients have gone on to acquire record funding from renowned investors, including this most recent developments in the case of our client, BankOpen.

Have an idea that could change the face of the Indian FinTech market? You can visit our website for more information, or directly .